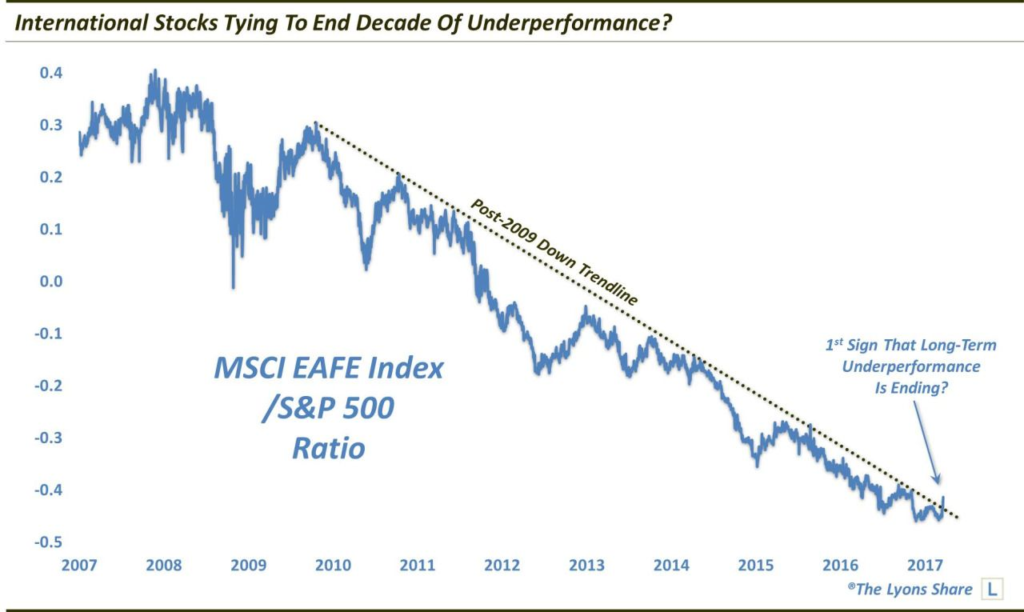

It was an interesting month in financial markets as U.S. stocks and bonds were largely flat, while international stocks (MSCI EAFE) surged 2.75%. This surge of international stocks has been very short-lived so far, but the surge is worth noting due to its rarity. As illustrated in the chart below, international developed market stocks have been in a downtrend when compared to the S&P 500 for over seven years, a tremendous amount of time. Whether the recent performance of international stocks will be a sustained trend that lasts for more than a measly few months remains to be seen.

In other news for the month of March, the Federal Reserve raised the benchmark interest rate from 0.75% to 1.0%, an increase of 25 basis points. This move was largely expected by the market and therefore had little impact on returns of stocks and bonds.

Below are the returns of major indexes for March:

| Index | March | YTD |

| S&P 500 (US large cap) | 0.12% | 6.07% |

| Russell 2000 (US small cap) | 0.13% | 2.47% |

| Barclays US Aggregate Bond | -0.05% | 0.82% |

| MSCI EAFE (developed international) | 2.75% | 7.25% |