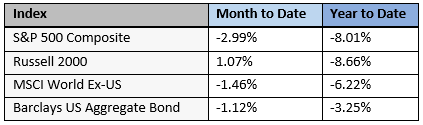

Here is a recap of market performance for the month of February and year-to-date:

February was another weak month for financial markets. US small cap stocks were the only category to make gains. US large cap stocks declined the most, while bonds and international stocks also lost value. So far this year, all four categories are down, but international stocks and bonds have outperformed.

Market Update – Russia/Ukraine Conflict

Naturally, the Russian invasion of Ukraine is the largest global news story today. While our job is to analyze the financial and market impacts, we are deeply saddened and dismayed regarding the violence being perpetrated on the Ukrainian people. Please join us in praying for Ukraine.

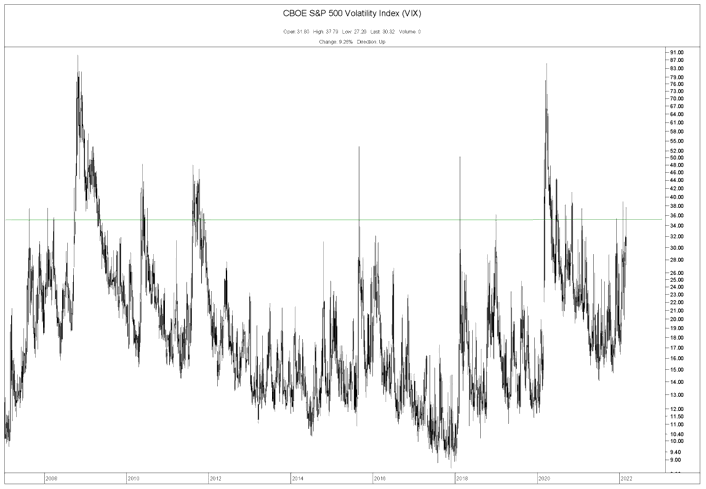

Financial markets have responded to this news. First, volatility has significantly increased. This chart shows the volatility of the S&P 500; it’s also known as the VIX:

Over time, VIX readings oscillate between 10 and 90, with lower readings during calm markets and higher readings during anxious markets. The green line is 35. Over the past 15 years, the financial crisis and COVID crash marked the highest readings. While markets haven’t reached that level of panic, volatility is definitely elevated. Historically, the VIX spikes quickly before reverting to lower levels. These spikes also tend to coincide with stock market lows, which means they tend to be attractive buying opportunities for investors with longer term time horizons. In other words, when investors are afraid, many of them sell. This depresses the market in the short term but leads to higher future returns as fear recedes and markets rebound. We can’t predict the scope and duration of the current conflict in Ukraine, but we will always encourage you to hold your investments through turbulent markets.

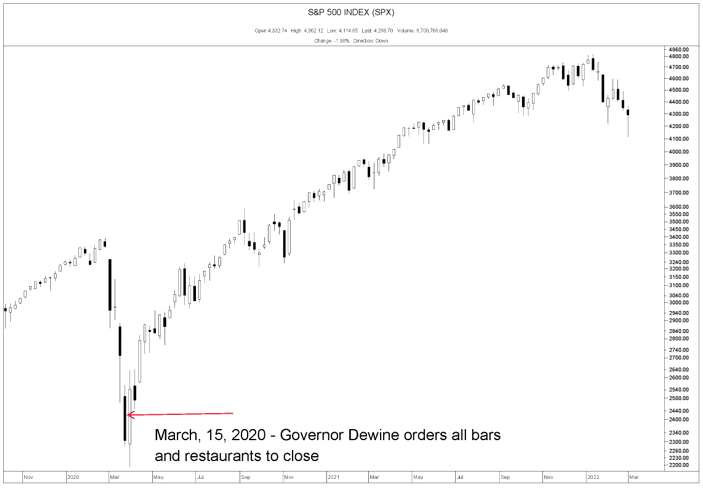

Second, financial markets quickly adjust to breaking news items and are always forward looking. Here is a weekly chart of the S&P 500 over the past two years:

During the coronavirus pandemic, markets began crashing in advance of large numbers of confirmed cases. The red arrow shows the point in time when Ohio governor Mike DeWine mandated the closure of all bars and restaurants due to risks surrounding COVID-19. At the time of this news, Ohio had only 37 confirmed COVID cases. But financial markets had figured out that the pandemic was going to be a big deal and had repriced accordingly. About a week later, the markets bottomed out and began rallying, well before any good news surrounding promising treatments or vaccines. Even though the pandemic was going to worsen, financial markets were improving.

Regarding the current crisis, the point is not that markets are guaranteed to go higher now. They could go lower, especially if the Russian aggression continues beyond Ukraine and into countries that are members of the North Atlantic Treaty Organization (NATO). Such action would cause the United States, United Kingdom, France, and other NATO allies to get involved militarily and would have very negative consequences. The point is that markets will rally before the resolution to this conflict becomes evident. So if investors want to wait until the conflict is resolved to buy investments, they will be buying at higher prices than today. This will decrease returns, which is another reason why we recommend holding investments through uncertainty.

If you would like to talk more about how these recent events have affected your portfolio specifically, please let me know.