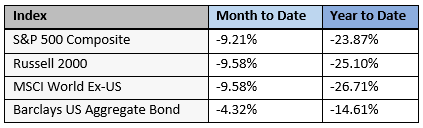

Here is a recap of market performance for September and year-to-date:

Financial markets declined in September. Bonds lost the least, followed by US large-cap stocks. US small-cap stocks and International stocks fared the worst. The same is true for the year to date.

Nervous Times, Big Decisions

The first nine months of 2022 have been extremely challenging for investors. All of the main stock categories listed above are down by more than 20%. Bonds, which have historically helped diversify portfolios against stock declines, are having their worst performance in the last 40 years. We have high inflation, tightening monetary policy, sharply higher interest rates, war, and the prospect of an economic recession.

Investors are nervous, and with good reason.

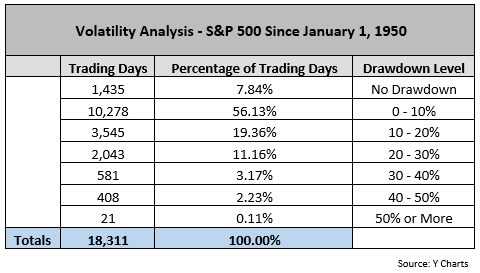

But while each instance of market volatility feels different and new, the truth is that we’ve been through this before. The following chart shows some interesting data on market declines since 1950:

Over the past 72 years, markets have only spent around 8% of the time at all-time highs. They’ve spent about twice as much time down over 20% from all-time highs, which is the situation we find ourselves in currently. And while markets could certainly fall further, history tells us that these periods don’t last long. They have been down 30% or more from highs around 5.5% of the time.

There is another side of the coin – historically, market declines provide opportunity for attractive future returns. Since 1950, 54 months have ended with the S&P 500 down between 20-25% from it’s high. On average, the annualized 3 year price returns from those months was 8.96%. And in addition, the dividend yield of the S&P 500 has been between 1-5% during that time. And in general, the higher the declines, the greater the future returns.

What should I do?

All of us have a choice to make during periods like this – we can either quit, or we can keep going. Historically, investors who quit (by selling their investments and going to cash) opt themselves out of higher returns in the future. Investors who keep going will likely be rewarded and reap attractive future returns. We saw this first hand during the financial crisis in 2008 and during the onset of the COVID pandemic in 2020.

The biggest advantage we have in markets is time. If you are an investor who is still working and saving, continue funding your retirement accounts and consider depositing additional cash if you can.

If you are retired and using your money, time is still on your side. In many cases, we find that investors may distribute 3-5% of their accounts annually. This means that most of your account will not be touched for a decade or more.

If you would like to talk more about how we can use the current market environment to your advantage, please let me know.