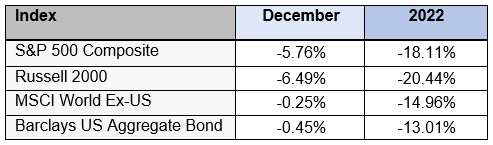

Financial markets had mixed returns in December. Bonds and international stocks were roughly flat, while US large and small cap stocks declined. For the year, all four asset classes went down in value.

Waiting on the World to Change

Over the past decade or so, three main trends emerged in the financial markets:

- Interest rates declined

- Technology stocks had higher returns than almost everything else

- US stocks outperformed international stocks

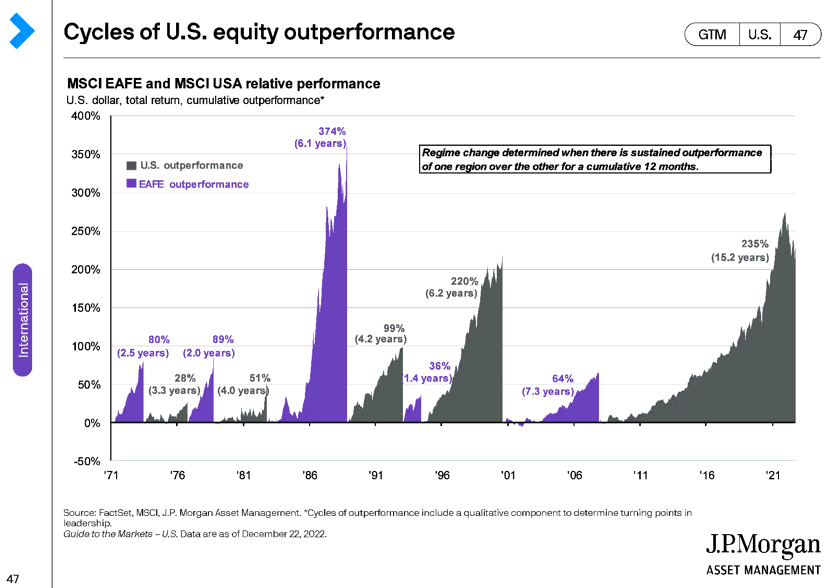

In 2022, these trends started to reverse. Interest rates went way up and technology stocks stopped doing as well. But as the war with Russia impacted much of Europe and the dollar stayed strong, US stocks kept outpacing international stocks. This graph from JP Morgan shows how persistent this trend has been:

The MSCI EAFE index tracks a basket of developed economy international stocks. Some of the biggest representation comes from countries like Japan, the United Kingdom, France, Switzerland, and Australia. Over the past 15 years, the EAFE index has trailed the S&P 500 by 235%. In other words, they have lagged by a lot.

Why would investors want to invest in countries that have lost by this much? Well, the graph also shows that this is the longest (both by years and by amount) US outperformance since 1971. The opposite has also occurred – when international stocks do better than US stocks: the 1980s and 2000s, for example.

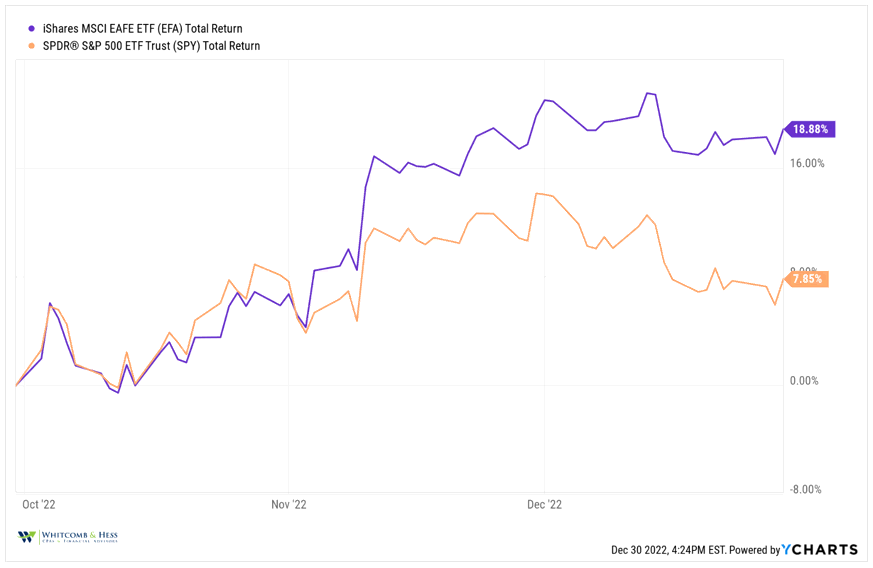

And now it may be happening again. Here is a look comparing EAFE stocks (purple) to US stocks (orange) during Q4 2022:

EAFE stocks have significantly outperformed US stocks recently. Time will tell if these long-term trends are set to reverse, but when they do, we believe investors with allocations to international holdings will reap the benefits of their patience.

If you would like to talk more about how we use this research to build your portfolio, let’s talk. As always, we are thankful for you, and the trust you put in our team.