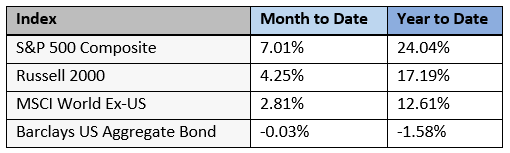

Here is a recap of market performance for the month of October and year-to-date:

October was a fantastic month for stock returns, with the S&P 500 leading the way. US small cap and international stocks followed the lead and also had attractive returns. Bonds were the notable laggard and moved little. Overall, it’s been a very beneficial year for investors. During this time, US stocks have outperformed international stocks, while bonds are down.

Municipal Bonds – Should I buy them?

A bond is a security that represents an agreement between a borrower and a lender. For example, when someone borrows money from a bank to purchase a home, and promises to repay it over the next 30 years, a bond is created. Bonds play a critical role in many investor portfolios because they provide diversification to the stock market and reduce risk.

As you may know, governments are by far the biggest borrowers of money and therefore the largest issuers of bonds. When the federal government issues a bond, it’s called a treasury. When a state or local government issues a bond, it’s called a municipal bond (or muni).

Typically, both treasuries and munis are considered extremely safe. The federal government has never defaulted on their bonds — in other words, they always pay them back. According to Moody’s, a company that assigns credit ratings to municipal bonds, from 1970-2020, the default rate on muni bonds was 0.08%. So when investors want safe bonds, treasuries and munis are both good candidates.

In order to incentivize their purchase, both treasuries and munis have tax advantages. Treasury bonds are exempt from state taxes. Munis are exempt from federal taxes. If you are an Ohio resident and buy an Ohio muni bond, that interest is also exempt from state taxes. Both types of bonds are generally exempt from local taxes.

So, when comparing treasuries to munis, the analysis can become somewhat complex. Here are some factors we consider:

- What is the difference in interest yield between a treasury and comparable muni bond?

- What type of investment account will hold the bond?

- If it’s a taxable account, what are the investor’s applicable federal and state tax rates?

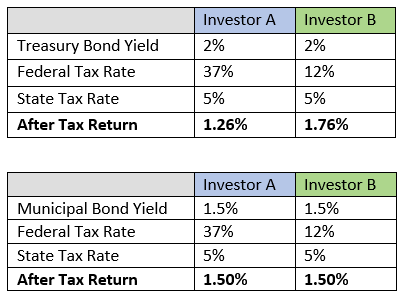

Here’s a hypothetical example showing which type of bond might be more beneficial to a given investor:

As you can see, the treasury bond has a higher yield than the municipal bond. The next step is to adjust the yield for the tax advantages of each bond. Because Investor A is in a much higher federal tax bracket, and municipal bonds are not federally taxed, this muni is attractive. But, Investor B should buy a treasury. His tax bracket is much lower, so the municipal bond is less beneficial. Because investors have unique tax situations, understanding both these variables is critical to determining the best investment option.

We consistently run this type of analysis in real life. In the current bond yield environment, we find that the vast majority of investors are better off in treasury bonds.