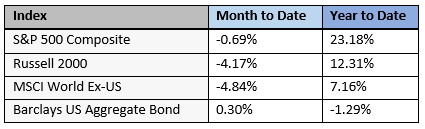

Here is a recap of market performance for the month of November and year-to-date:

3 Factors Affecting Higher Inflation

In November, the Bureau of Labor Statistics reported a 6.2% increase in the Consumer Price Index (CPI). The CPI is commonly used as a proxy for the US inflation rate. Measuring the cost of a wide array of goods and services, the CPI reports an annualized inflation rate on a monthly basis. Since May, the CPI has been 5% or higher every month. Because consumers dislike high inflation (who wants to pay more for things?), the CPI has been newsworthy. Here are three factors affecting inflation, and what the future may look like for each.

1. Monetary Policy

The Federal Reserve Board (the Fed) is the central bank of the United States. They set interest rates based on achieving two objectives: price stability and maximum sustainable employment. High interest rates may mean stable prices, but slow economic growth and higher unemployment. Low interest rates may mean higher inflation, but higher levels of employment. The goal of the Federal Reserve is to balance these somewhat competing objectives.

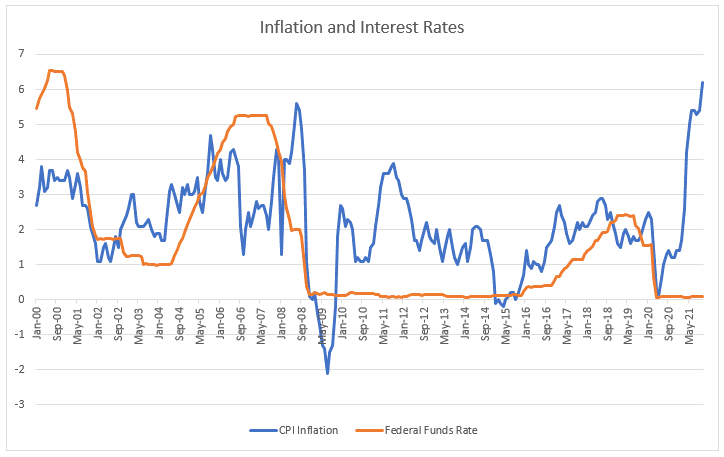

The following graph shows the CPI inflation rate and the Federal Funds interest rate going back to the year 2000:

Following the financial crisis in 2008, the Fed kept interest rates (the orange line) essentially at zero in order to stimulate an economy that had been decimated by the Great Recession. In theory, low interest rates cause higher inflation. But for over a decade, inflation (and economic growth) remained stubbornly low. To modify a common saying, “You can lead people to cheap money, but you can’t make them spend it.” Due to the trauma from the financial crisis, most Americans paid down debt and reduced spending. So despite very accommodative monetary policy for years, people weren’t willing to borrow and spend as they had before, leading to continued low inflation.

Then in 2020, COVID came, blowing another hole in economic growth. But unlike the Great Recession, this time policymakers had another tool ready.

2. Fiscal Policy

While the Fed has control over monetary policy, Congress influences fiscal policy through changes in tax rates and changes in federal spending.

In October of 2008, Congress passed the Troubled Asset Relief Program (TARP), which authorized $700 billion of federal spending. A lot of money, right? But in March of 2020, Congress approved the Coronavirus Aid, Relief and Economic Security (CARES) Act, approving $2.2 trillion in spending.

Furthermore, while TARP funds were used to purchase stock and loan funds to financial institutions, much of the CARES money went directly into the hands of small businesses and consumers. One of the main goals was to distribute money to people who would spend it.

Practically speaking, it is difficult to know how much of the CARES Act stimulus money was spent in various categories, but most commentators agree that compared to 2008, more relief money actually got into the real economy. This means more demand, higher prices, and a bigger effect on the CPI inflation numbers.

3. Supply Chains

While monetary and fiscal policy have increased demand, which increases prices and thus inflation numbers, reductions in the supply of goods and services can also increase prices. If the supply of a good is constrained and unable to meet demand, price will increase. A couple examples include:

Global Manufacturing – many of the world’s goods are made in Asia, specifically China. The Chinese government has been aggressive in combatting COVID cases through lockdowns, shutdowns, and regulating people and commerce. This means less stuff gets made, and in general, stuff gets made slower. Whether you are looking to buy soccer jerseys or semiconductors, you might have to wait longer or pay higher prices.

Housing – Since many Americans have been spending more time at home, there has been increased demand for home renovation projects, causing shortages in lumber, roofing, and other commodities. Also, because of the pain inflicted on the housing industry during the financial crisis, there were years of below average new home construction in the 2010s. The cost of housing accounts for about 1/3 of the CPI calculation. So if housing costs more, it’s going to drive the inflation rate higher.

So What Now?

While current inflation numbers are high, there are some reasons for optimism. First, it signals that the economy is recovering well. Unemployment has decreased and wages have increased. Second, the effects of stimulating fiscal policy and the current supply chain disruptions will be temporary. Third, markets have powerful correcting mechanisms. It may take time, and we may continue to see some elevated inflation numbers for now, but supply and demand are dynamic and tend toward equilibrium. Fourth, if inflation does continue to last longer than expected, policymakers have tools available to help moderate inflation, such as increasing interest rates. By raising short term interest rates, the Fed can incentivize additional saving, which in turn reduces demand and helps ease inflation pressures. It is also less likely Congress will authorize additional spending bills such as the CARES Act if inflation picks up. Those bills tend to be passed during periods of severe economic stress.

To say the global economy is complex would be an understatement. Policymakers have a difficult job and many factors to balance and consider. If you have any questions on inflation and how it affects your investment portfolio, let’s talk.