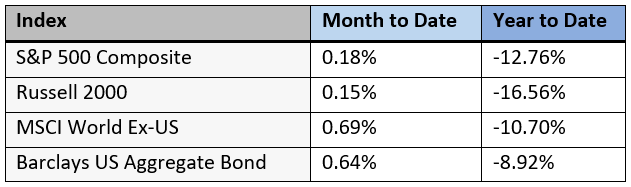

Here is a recap of market performance for May and year-to-date:

Market volatility continued in May, but stocks began to rally toward the end of the month. Overall for the month, US large and small stocks ended up relatively unchanged, while bonds and international stocks increased. During the year, while both bonds and stocks have decreased, bonds and international stocks have outperformed US large and small caps.

The Almighty Dollar

Most investors keep a watchful eye on the performance of US stocks and bonds because they have direct impact on their investment portfolio. To a lesser extent, they may be aware of commodity prices such as oil, gasoline, wheat, rice, or corn because they purchase these products frequently. Unless you plan on traveling abroad, the currency markets have smaller direct effects on our day-to-day lives. But even though they may be less visible, they have a large impact on movements in financial markets.

The chart below shows the value of the dollar index (DXY). It measures the value of the dollar, relative to the following currencies:

- Euro (57.6% of index)

- Japanese yen (13.6%)

- UK pound sterling (11.9%)

- Canadian dollar (9.1%)

- Swedish krona (4.2%)

- Swiss Franc (3.6%)

Over the past six years, the value of DXY has fluctuated between roughly 88 and 105. The higher the index, the stronger the dollar is against the six foreign currencies, and vice versa. Because dollars are the most stable global currency, their value tends to increase during periods of market stress. In other words, investors buy dollars when things get scarier. For example, the second and third red circles at the top indicate the height of the coronavirus pandemic and continuing war in Ukraine. Both of these were volatile periods in the stock market.

Another note is that DXY has traded inside a range. Three times the index has stopped its decline around the 88 level, and started going up. Three times the index has increased to around 103, and then started to decrease. If these trends continue and the dollar continues to go down, it could signal both a potential rally in the stock market as well as help the performance of international stocks specifically.

If you would like to talk more about the value of the dollar and its impacts on your portfolio, please let me know.