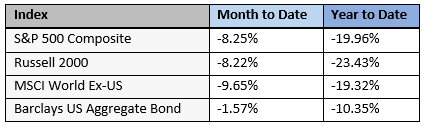

Here is a recap of market performance for June and year-to-date:

Markets have continued to decline through the end of June. Overall, bonds have held up best, while all stocks categories have fared poorly. Since the beginning of the year, all four asset classes are down double digits, and all stock asset classes are in bear markets.

What Can We Learn from the Bad Times?

This past quarter has been especially challenging for investors, which got us wondering how this period compares to prior negative market environments. It’s not fun to look back on prior market declines, but we can learn something from those times.

The following graph shows quarterly S&P 500 returns since 1999. This time period encompasses the bursting of the technology bubble at the turn of the century, the financial crisis of 2008, the COVID crash of 2020, and today:

The red boxes outline higher volatility in the market. You’ll notice severely negative periods tend to cluster with the most positive periods. It’s crucial to realize that when markets bottom out, they tend to bounce back quickly and powerfully. Investors who sell investments during these down markets risk missing out on market advances when they occur.

Additionally, there have been 10 prior calendar quarters where the S&P 500 fell by 10% or more. This table shows market returns after those periods ended:

No one can see when the markets will bottom, except in hindsight. But generally, after very poor periods in the market, forward returns become very attractive. While down markets evoke the fear of losing more, when you look at historical data, investing during these periods actually decreases your chances of negative returns over the next few years.

Down market environments are formidable and require thoughtful decisions instead of compulsive, emotional ones. We can help you use difficult times to your advantage.

If you would like to talk more about your portfolio, please let me know.