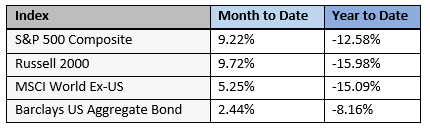

Here is a recap of market performance for July and year-to-date:

Markets have rallied to start the second half of the year. US small-cap and large-cap stocks led the way, followed by international stocks. Bonds are also higher, but have trailed on a relative basis. Since the beginning of the year, bonds are down the least, while stocks are still down double digits.

Are We There Yet?

As we’ve written before, the main themes in financial markets this year are higher inflation and interest rates. Markets have been adjusting (downward) as rates have risen. At the beginning of the year, the Federal Funds rate was zero. Last week, the Federal Reserve raised it to a range of 2.25 – 2.50% in an effort to try and combat persistently high inflation. While interest rates still remain relatively low, this significant change has been a factor in higher market volatility.

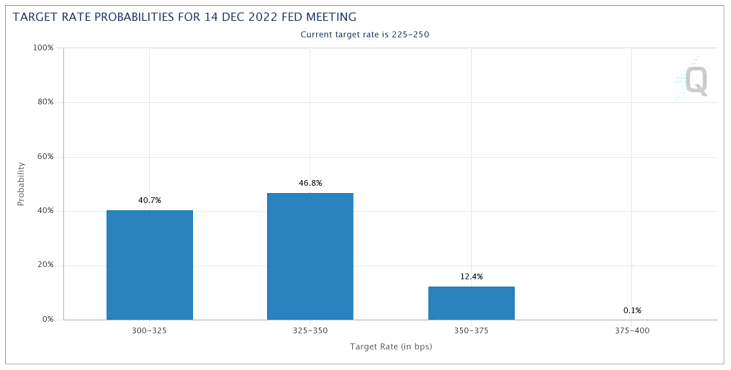

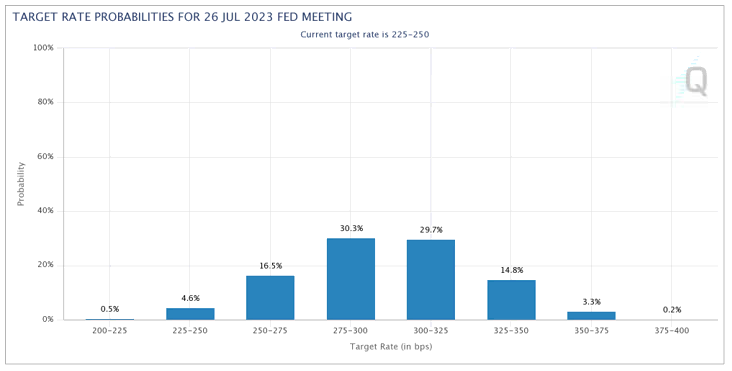

That being said, the biggest question in markets is not, “Where are we now?” but rather, “Where are we going?” Everyone expects the Fed to continue to raise interest rates in September, but at where will they be six — or twelve — months from now? The answer to this question will have a big impact on how stocks perform. Here are two charts that give us some insight:

The first chart shows the probability of how interest rates may change after the Federal Reserve meeting on December 14, 2022. For example, there is a 40.7% chance it will be 3 – 3.25%. The second chart shows these probabilities after the meeting on July 26, 2023– roughly a year from now.

The biggest observation from these charts is that while markets expect higher rates through the end of the year, they also expect the current rate hiking cycle to be nearing its conclusion. In fact, if the path of rates plays out according to these graphs, the Fed may begin lowering rates sometime in 2023. This would mean less concern over inflation, and potentially a more stable interest rate environment and a calmer stock market.

If you would like to talk more about how interest rate movements can affect your portfolio, please let me know.