With the end of the year approaching, we wanted to remind you of a few things to consider regarding your retirement accounts.

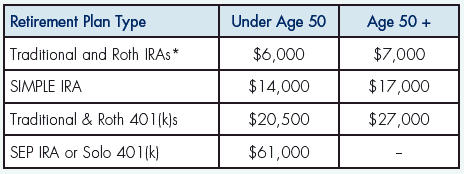

Have you fully funded your Retirement Savings? Here are the contribution limits for 2022:

Have you satisfied your Required Minimum Distribution (RMD)? IRA owners must withdraw a minimum amount from their account annually starting in the year they turn 72. 2022 RMD amounts are calculated using your 12/31/2021 account balance and your life expectancy. Stay tuned, RMD rules may be changed in the future!

Have you considered a Qualified Charitable Distribution (QCD)? Do you have a heart for charity? Consider a QCD to satisfy all, or part, of your RMD. QCDs are a way to transfer funds directly to a qualified charity of your choice in a tax-free event!

If you would like to discuss how this applies to your financial plan, let’s talk!