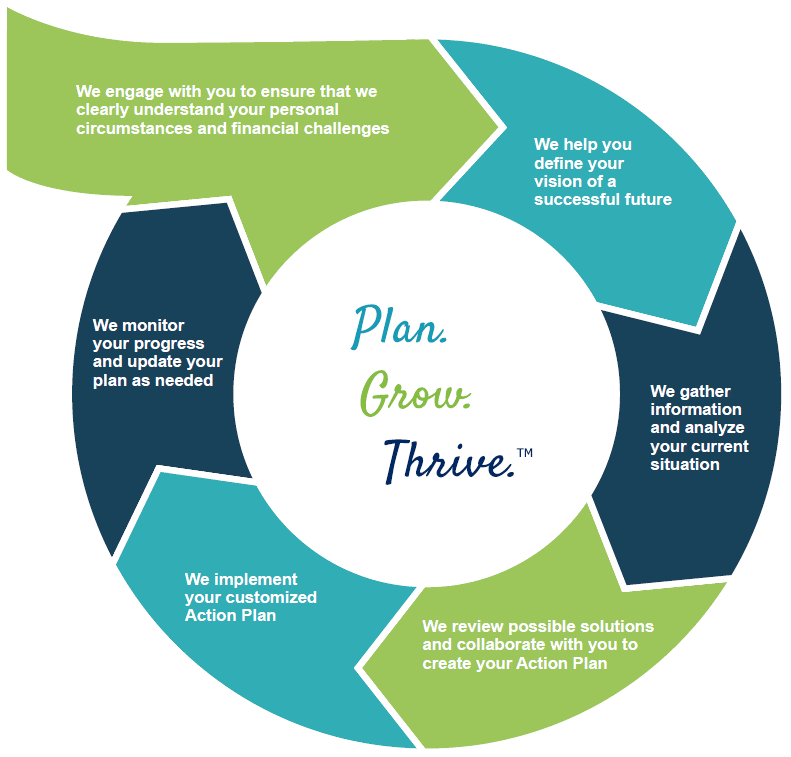

Wealth Management is an ongoing process that incorporates all aspects of your finances. Even your personalized plan will evolve and change as your goals change, or as you go through phases of life. It’s a journey, and we’re here to walk you through it!

Tax Planning

We use tax planning in everything we do. Whether it’s personal income, starting a business, retiring from a career, or planning an estate, nearly everything has a tax consequence. We integrate our tax knowledge into every decision, so you can keep more of the money you’ve earned.

Retirement Planning

We know that the prospect of transitioning into retirement can be stressful: you’re essentially making once-in-a-lifetime decisions. But you don’t have to do it alone. To provide you with peace of mind, our advisors help you develop a “Retirement Roadmap.” We integrate any investments, pension accounts, Social Security benefits, annuities, and insurance to make a comprehensive plan that’s unique to you. We also understand that your plan should be fluid. If your needs change, the “roadmap” needs to adjust. Our advisors are like tour guides: they will walk with you every step of the way.

Estate Planning

While it’s not a fun or easy subject to discuss, it’s important to think about what happens when you’re gone. If you have young children, who will care for them? If you have multiple heirs, how do you know they’ll receive what you’d like to leave to them? Everyone has heard stories that didn’t end well. We don’t want that to happen to your loved ones. Let us help you make sure your estate plan is in great shape.

Social Security & Medicare

Without knowing all your Social Security options, or how to maximize your benefits, you may be leaving money on the table. No one wants that. Our team can analyze all your options to make sure you have a plan to optimize your benefits.

College Planning

Many people remember their college days fondly, but wouldn’t it be better without years of debt afterward? With tuition costs rising and so many options, finding the best way to save for future education costs can be daunting. We have helped many parents (and grandparents!) sort this out.

Life Insurance & Annuities

Life insurance comes in many different formats and we can help you find the type that best fits your family. Our team can review your coverage on everything from home and auto, life insurance, long-term care, and business owner’s coverage. We can help you find the balance between making sure you are covered, and not paying for more than you need.

There is no need to bounce around to other advisors when you can get all your investments, insurance, and tax planning done here with one team at Whitcomb & Hess. When you’re ready, let’s talk!