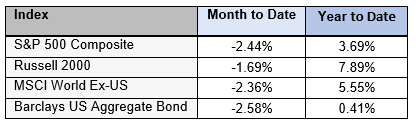

Here is a recap of market performance for February and year-to-date:

Markets declined in February. US small cap stocks declined the least, while US large cap, international stocks, and bonds were all down similar amounts. For the year, all stock categories have provided positive returns, and bonds are also slightly up.

The War in Ukraine – One Year Later

It’s hard to make predictions – especially about the future.

– Yogi Berra

February 24th marked one year since the Russian invasion of Ukraine, the most newsworthy event of 2022. While the war has impacted the global economy and financial markets, there are discrepancies between what people thought the impacts would be a year ago and what actually happened. To show one example, here are two headlines from the Financial Times regarding natural gas and oil prices. The first is from the date of the invasion:

At the time, this headline made sense. The invasion cast substantial doubt over potential supply of natural gas, oil, wheat, and other commodities. While no one knew all of the ramifications of the invasion in the longer term, the markets responded quickly. The prices of these commodities shot higher, and many people predicted this upward trend would continue.

The second headline is from two weeks ago:

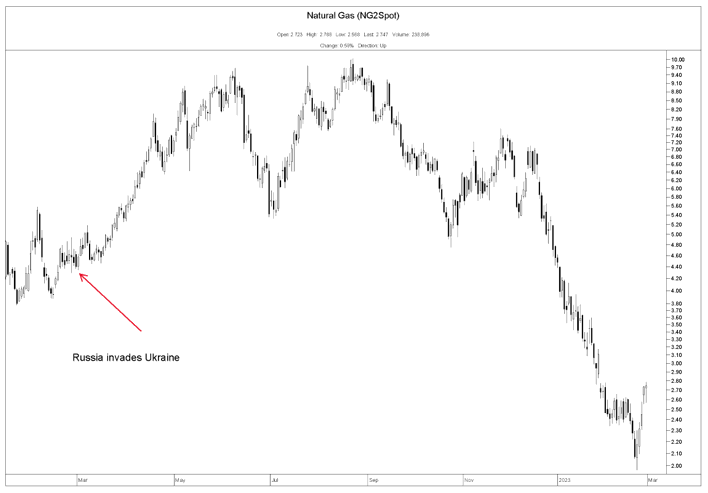

Over the past year, as the initial shock of the war receded, prices of many commodities have stabilized or fallen. For reference, here is a chart of natural gas prices over the past year:

While the price of natural gas continued to climb through the summer, the upward trend of prices reversed. Since August, natural gas fell by 80% from its highest to lowest price, before rebounding recently.

As investors, what lessons can we take from this?

- Certainty is elusive – No matter how obvious the future seems, there is always a chance for the unexpected to occur. It seems logical to think that natural gas prices will recover and go higher from this point. They probably will, but it’s also possible they go lower or sideways, too. In other words, nothing is certain except uncertainty.

- Diversify your portfolio – One of the most common investing mistakes is to put too much money in any one thing. Typically, people do this when they have a high degree of conviction regarding the success of the investment. After all, if you are certain something will work, you put in as much money as possible. Imagine a commodity trader who invested heavily in natural gas, assuming that prices had to continue higher. It wouldn’t have worked out well. Over the years, we’ve seen people get very excited about many investments: gold, crypto, technology stocks, even cash. In most cases, too much of any one investment turns out poorly over time. We should be wary of an “all or nothing” outlook. It’s actually about finding the appropriate balance.

- We live with the consequences – It’s hard to invest on news headlines. Media companies report what is happening now, and they tend to assume that tomorrow will look like today. Also, they want our attention and will capture it by any means necessary. It’s not bad, but it’s important to recognize. They don’t have to live with the investing decisions we make – we do. The future version of you has to live with the decisions that current you is making.

If you would like to talk more about how current events can impact your portfolio, please let me know. As always, we are thankful for you, and the trust you put in our team.