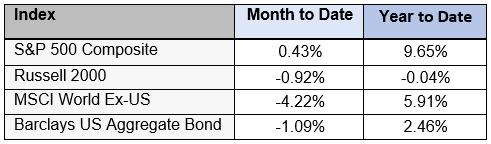

In May, market performance was mostly negative. US large cap stocks inched higher, while small cap stocks, bonds, and international stocks declined. For the year, US large cap stocks lead, followed by international stocks. Bonds have also had positive returns and small cap stocks are flat.

The Debt Ceiling – How Did We Get Here?

Undoubtedly the most pressing financial news item in May was the US fiscal debt ceiling. Currently set at $31.4 trillion,

the debt ceiling places a hard legal limit on federal government borrowing. Since the government spends more than it takes in every year, it must continually issue bonds and borrow money to finance the entirety of the spending.

This January, government borrowing hit the limit, which means cash in the treasury has been trending lower all year. As this cash approaches zero, Congress has a choice – either raise the debt limit and allow new borrowing, or the government runs out of money. While no one knows exactly when government cash will reach zero, Treasury Secretary Janet Yellen has estimated it would happen sometime in June. So over the past weeks, the Biden administration and Congress have been negotiating the terms of a debt deal. Once it passes, the government can issue new debt and continue its operations with the cash it receives.

How did we end up in this situation? A little bit at a time.

The Second Liberty Bond Act of 1919, which was designed to raise money to pay for World War I, started us down this road. While it did not set a debt limit, it was the first legislation to mention the concept of a debt ceiling as a way to police excessive spending. In the 1930s, Congress passed a series of Public Debt Acts, again with the goal of regulating federal spending. These laws set the general framework requiring Congressional approval of any borrowing in excess of a current limit.

Since these initial pieces of legislation, Congress has consistently increased government spending, and in turn, the debt limit. In fact, according to treasury.gov, since 1960, Congress has acted 78 separate times to raise, extend, or revise the terms of the debt limit. Both political parties have been involved – the limit has been changed 49 times under Republican Presidents and 29 times under Democrats.

How Does This Affect Me?

What started as a check and balance on spending has turned into a necessary process to keep the government operational. Without increasing the limit, the treasury would have to make impossible decisions on who to pay and who not to pay. This would result in huge economic and market dislocations, which is why members of both political parties and Secretary Yellen have all stressed the importance of raising the debt ceiling.

In other words, it’s absolutely imperative that Congress raise the limit. If they don’t, markets would go significantly lower until a resolution is reached. In fact, some clients have asked us whether or not their investment allocation should change based on the progress of negotiations.

While political negotiations are tricky, dramatic, and unpredictable, we believe that the debt limit will be raised, as it has been many times throughout history. Yesterday, the House of Representatives passed a bill, which will now go to the Senate for approval. After that, President Biden can sign it into law. All of this looks likely. Leaders of both parties understand the necessity of raising the debt ceiling and the potential for harm if a deal is not reached. More importantly, political points will be lost if the economy and markets are negatively affected by an issue that is clearly avoidable.

Thank you for the trust you put in our team. If you would like to talk specifically about your current financial situation or other investment-related risks, please let your advisor know.