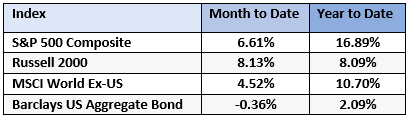

In June, stocks rallied. While US small caps led, large caps, and international stocks also had attractive returns, while bonds slightly declined. For the calendar year, all four asset classes are higher.

Two Big Factors to Consider When Investing

Investors are constantly being bombarded with news and noise. Will the Federal Reserve increase interest rates next month? Are our levels of government debt sustainable? Will artificial intelligence rescue or ruin us? Is inflation too high or too low? While all of these questions may be somewhat important, they are only tangential to the main factors that influence investing outcomes over time.

Let’s say you are investing in a broad-based stock index such as the S&P 500. At its very core, your results will be determined by two main factors:

- Business performance – In the long run, are the companies in the index selling higher amounts of goods and services? Are they improving their efficiency and growing their margins? Are their profits going up over time? Are they able to convert these profits into higher cash flows? These are commonly referred to as fundamentals – if they improve, the value of the investment goes up.

- The price you pay – If you are buying any asset, whether it’s a house, a car, or a stock index, you want to pay a reasonable price for acquiring it. The higher the price you pay relative to the fundamentals, the harder it is to make high rates of return over time.

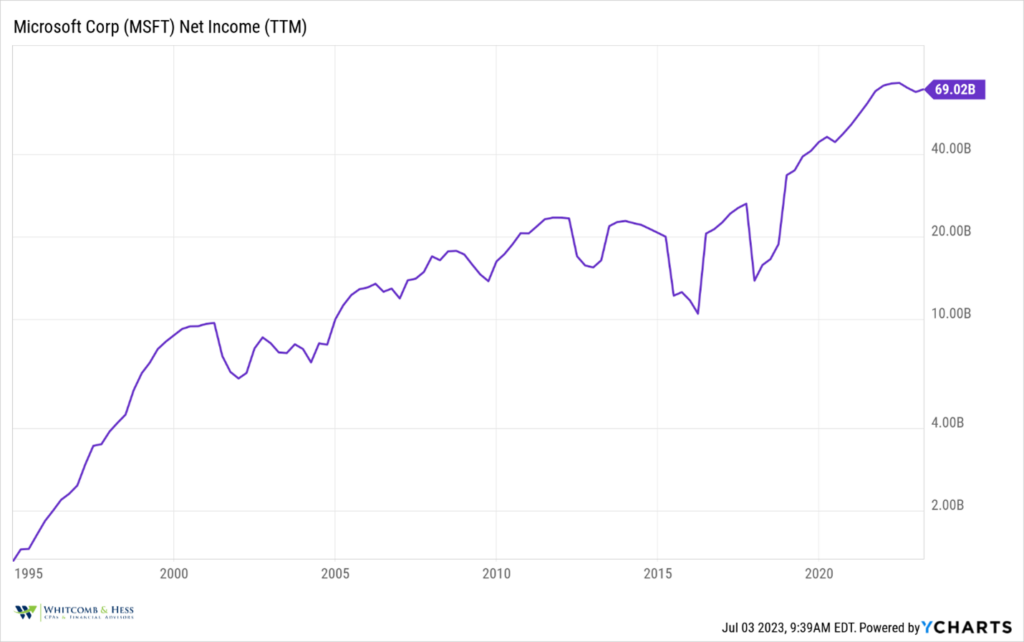

Let’s look at Microsoft (MSFT) as an example of how these factors affect investor results. Here is a chart of MSFT Net Income since 1995:

MSFT business performance has obviously been very strong. While there are periods where profits declined, over time they have increased by over 50x. Clearly, this increase in earnings means the value of the company also increased significantly.

Here is a chart of the price/earnings ratio of MSFT during the same time frame:

This chart tells a more nuanced story. At times, such as the late 1990s, investors were willing to pay as high as 80x earnings to buy MSFT. At the apex of the financial crisis in 2009, you could buy it for only 8x. Or think of it this way: the higher the P/E ratio, the higher the demand for the investment. In other words, more people are willing to buy, which drives the price higher. And the opposite is also true.

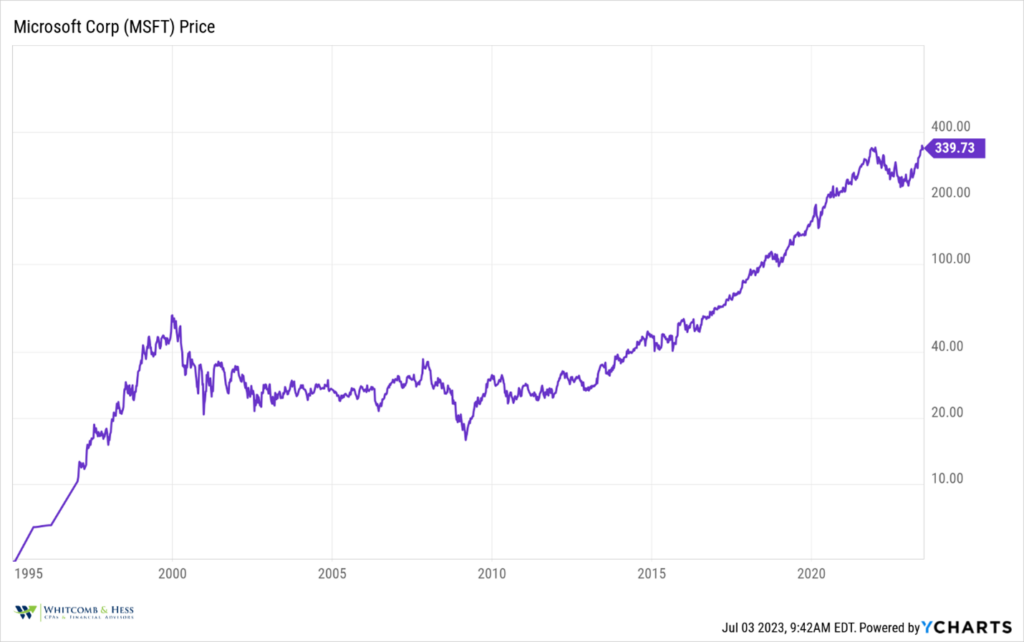

One final chart – here is the historical price of MSFT:

From 2000 – 2009, the price of MSFT stock fell by over 70%, even though during that same time frame, company earnings doubled! This means while the company performance improved, investors lost a lot of money. Why did this happen? Because during the technology bust of 2000-2002 and the financial crisis in 2008, investors were no longer willing to pay the high prices of the 1990s. The P/E ratio collapsed.

As your advisor, it’s important for us to recommend investments that grow profits over time. But equally as important, we must pay attention to the prices that we pay to acquire these investments. If we pay too high a price, we can lose money even in an investment with improving fundamentals. So, we look at both of these factors when managing your account.

If you would like to talk more about how this affects your investment portfolio, please reach out to your advisor.