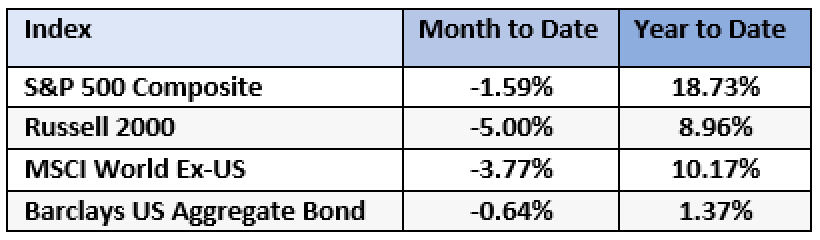

In August, markets declined, with US small caps the worst offenders. Large caps, international stocks, and bonds also went down. For the calendar year, large cap stocks have performed best, while small caps and international stocks also had positive returns. Bonds are slightly up.

Two Return Calculations

Did you know that there are multiple methods for determining the rate of return on your investments? Two of the most popular are time-weighted and dollar-weighted. Time-weighted returns treat each specified time period equally, while dollar-weighted returns place more emphasis on periods when the portfolio is larger.

For example, suppose someone invests $10,000 on January 1st when the S&P 500 is at 4,500. During the first six months of the year, the index increases to 5,500. Over the last six months of the year, it declines back to the original level at 4,500. If there were no deposits or withdrawals into the account during the year, the time-weighted and dollar-weighted returns are the same – 0% – because the index finished the year exactly where it began.

However, let’s imagine that our investor was pleased with returns over the first half of the year and decided to invest an additional $100,000 to his original $10,000 on July 1st when the S&P 500 was 5,500. While the time-weighted return of the index is still 0%, our hypothetical investor deposited a total of $110,000 but his year-end account balance is $91,818. His dollar-weighted returns are quite negative because of his unfortunate timing. Obviously from an investor perspective, it’s the dollar-weighted returns that matter most!

Morningstar’s “Mind the Gap” Study

Morningstar Investment Research does an annual study (which they call “Mind The Gap”) estimating the differences between investors’ time-weighted and dollar-weighted returns. The most recent update of the study showed that for the decade ending December 31, 2022, the average investment fund gained 7.7% annually (time-weighted return) while the average dollar invested earned only 6.0% annual (dollar-weighted) return. This means that investors, on average, made 1.7% per year less than they might have because of ill-timed deposits or withdrawals from their accounts.

Of course, there are lots of reasons people add and pull money from their investments. Sometimes these factors are out of our control – life just happens. But sometimes, investors make reactionary, emotional decisions based on recent market performance. People tend to withdraw money after bad return periods and add money after good periods. This helps explain the difference between time-weighted and dollar-weighted returns.

How Does This Affect Me?

As investors, we want to get the highest returns possible on a dollar-weighted basis. After all, that’s the measurement that affects us the most. The money movements into and out of our accounts matter – it’s not just about how a fund performs over time. The timing of large deposits or withdrawals has a large impact on our performance. Consider the following questions:

- If I’m adding or withdrawing a large sum of money, how much is market performance factoring into my decision?

- When markets decline, can I take advantage by adding more money to my account? How does this make me feel emotionally?

If you want to talk more about how this affects your personal situation, let us know.