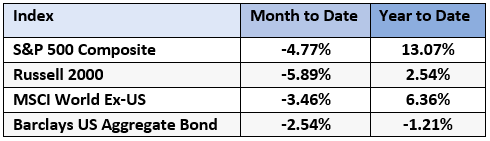

In September, markets went down. US stocks declined the most, followed by international stocks. Bonds also lost money. For the calendar year, US large cap stocks have performed best, followed by international stocks. Small cap stocks are up less, and bonds have moved into negative territory.

Higher for Longer?

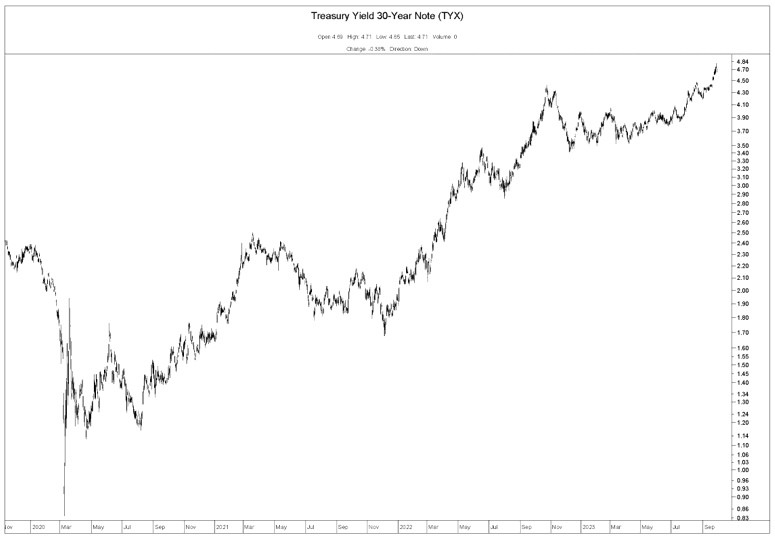

In September, interest rates on long-term treasury bonds continued to increase. Here is a graph showing the movement of these rates over the past few years:

At the peak of the pandemic, these interest rates fell below 1%. Now, they are approaching 5%. These movements can have big implications for bond prices and returns.

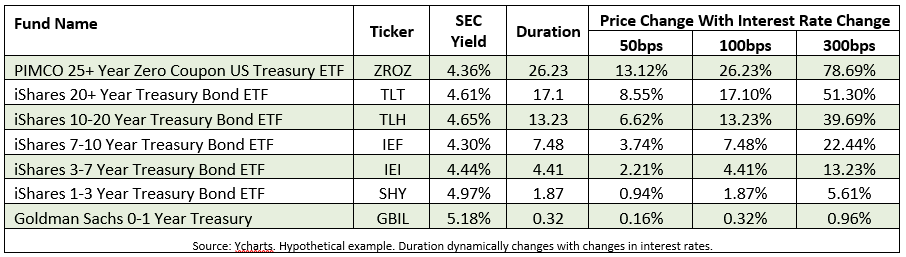

When interest rates increase, bond prices go down (and vice versa). “Duration” is a mathematical calculation that describes how sensitive a bond’s price is to changes in interest rates. The chart below shows a variety of funds that invest in treasury bonds. Duration can vary significantly between them; bonds with longer terms have higher durations. When interest rates rise, the bonds with higher duration have a more significant decrease in price.

The total return of a bond is determined by the yield plus the percentage change in price. (The SEC yield shows the approximate rate of return on a bond if interest rates don’t move.) Interestingly, 0-1 year treasury bonds (like GBIL at the bottom of the table) have the highest yields despite being the shortest term. They also barely change in price if interest rates change, so their returns are highly predictable. Meanwhile, funds at the top of the table like TLH, TLT, and ZROZ will have large changes in price if interest rates move significantly; this will outweigh the current yield. These funds would be great for investors if interest rates go down, but very bad news when rates go up.

Our investment team has conversations about these rate movements frequently and how they impact our recommendations to you. If you want to talk more about how changes in interest rates can affect your personal situation, let us know.