Market Recap

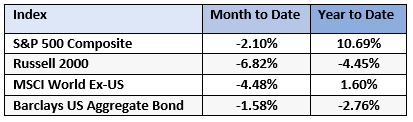

In October, financial markets continued lower. US small cap stocks declined the most, followed by international stocks. US large cap stocks and bonds also lost money. For the calendar year, US large cap stocks have performed best, followed by international stocks. Small cap stocks and bonds have moved into negative territory.

News Stories Continue

The combination of troubling news stories and negative financial markets continued through October. Republican Kevin McCarthy was removed as Speaker of the House of Representatives and replaced (eventually) by Mike Johnson of Louisiana. Hamas, a Palestinian terror organization, attacked Israel, sparking speculation about the potential for another international conflict or regional war.

While these stories are unique to October, more broadly speaking, there is always the possibility of something negative happening in our world. How should investors react to these headlines when they inevitably come? We believe a strategic and disciplined mindset is best (rather than impulsively reacting). Here are some guidelines we suggest:

- Stay Informed: First and foremost, stay well-informed about the events that are relevant to your investments. Monitor reputable news sources and be aware of the economic, political, and social developments that can impact the markets. We don’t want you to bury your head in the sand.

- Maintain a Long-Term Perspective: Most news events have significant short-term impacts which dissipate over time. It’s essential to keep a long-term perspective when making investment decisions. Avoid making hasty buy or sell decisions based on short-lived market volatility caused by breaking news.

- Assess Relevance: Not all news events are equally important for all investments. Investors should assess the relevance of a news event to their portfolio. Some news may be market-moving, while others have little impact. Focus on economic news that is most likely to affect your investments directly.

- Diversify: Diversification is a key strategy for managing risk. A well-diversified portfolio is less vulnerable to the impact of any single news event. Diversification can help balance losses in one asset class with gains in another.

- Have a Plan: Successful investors have a well-defined investment plan and strategy. Before any news event occurs, have a clear plan in place that outlines your investment goals and risk tolerance. Stick to your plan even when faced with unexpected news. In other words, expect the unexpected.

- Emotion Control: Emotional reactions to news events can be detrimental to investment decisions that go against a well-thought-out strategy. Maintain emotional discipline and avoid panic buying or selling.

- Consult Experts: Talk to us – we can provide perspective and guidance to help you make informed decisions.

Financial markets are dynamic – they move and change all the time. If you want to talk more about how recent events affect your investments, let me know.