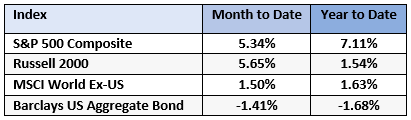

In February, stocks increased in value. US small cap performed best, followed by US large cap and international. Bonds declined. For the calendar year, the same is true. All three stock categories have gone up, while bonds have decreased.

The Hottest Stock In The World

Over the past 75 years of stock market history, there are dozens of stories of companies that started small but grew into dominant forces that changed the world. IBM, General Electric, Coca-Cola, Exxon Mobil, Walmart, Home Depot, Microsoft, Amazon, and Apple are just a few examples. Each of these companies have iconic brands as well as impressive stock performance.

Over the past few years, another company has joined this exclusive group and generated perhaps more buzz than any of them – NVIDIA (NVDA). Founded in 1993, NVDA designs and manufactures semiconductors. Originally used mostly in video gaming products, over the past decade their chips have been used in another huge technological breakthrough – data centers for artificial intelligence (AI).

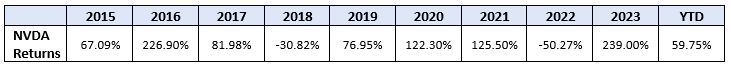

NVDA stock has done phenomenally well – the following chart shows calendar year performance over the past 10 years:

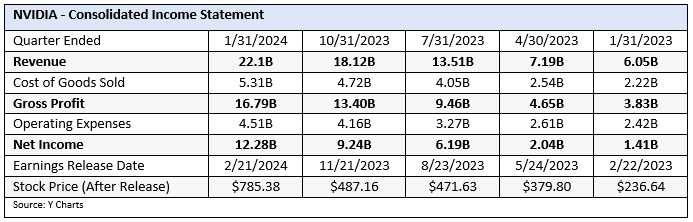

Over this time, NVDA has grown to become the third largest stock in the world by market capitalization. It currently comprises about 4.5% of the S&P 500 index. In the long term, stocks go up for one reason: their earnings go up. The earnings release in February confirmed what investors expected – NVIDIA is making a lot of money. Here is a consolidated look at their income statement over the past year:

As the chart shows, NVIDIA’s revenues have increased by over 3.5x since the quarter ended 1/31/23. More extraordinarily, their net income has gone up over 8.5x during the same period. This is because their expenses have gone up much less than their revenues. Their gross profit margin (gross profit/revenue) has increased from 63% to almost 76%, while their net profit margin (net income/revenue) has gone from 23% to over 55%.

These are incredible financial results. Semiconductor companies have much higher profit margins than financial or energy companies. However, NVIDIA is also crushing direct competitors like Intel or Advance Micro Devices (AMD). Uniquely profitable companies tend to be quite polarizing, causing investors tend to react emotionally in one of two ways.

- Cheerleaders – They get excited, not only because of the performance of the company, but also because it’s involved in groundbreaking new technology. While no one knows for sure what the future of AI will be, most agree that it’s likely to increase productivity and efficiency over time – and it’s already doing that. These investors are thrilled with the company, see blue skies ahead, and want to be a part of things.

- Naysayers – They get concerned, pointing out that even the best performing stocks have volatility. During a 3-month period in 2018, NVDA declined by over 57%. From November 22nd, 2021, through October 13, 2022, NVDA lost almost 69%. These levels of volatility make it challenging for investors to maintain large exposures to any company, even the best ones.

While both groups make valid points, from our perspective, the most successful investment decisions are a result of a nuanced and balanced framework. Consider the following three levels of analysis:

- Basic – It’s a great company! Let’s buy it!

- Price Aware – It’s a great company! If we buy it at the current price, how likely are we to make attractive returns in the future if the company continues to perform as it has in the past?

- Risk Aware – It’s a great company! If we buy it at the current price, what will our returns be if the company performance slows – either through less revenue growth or increased expenses?

Each step adds a sense of open-mindedness, humility, and thoughtfulness to whatever the final decision will be. If you want to talk more about how NVDA affects your current investment portfolio, let us know.