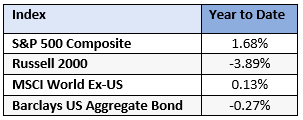

This month, financial markets had mixed returns. US large cap and international stocks increased, while small-cap stocks and bonds declined.

Buy Low, Buy High?

On January 19th, the S&P 500 closed at 4,839.81 – a new all-time high. This made headlines because it was the first record high in over two years. The last time this happened was January 3rd, 2022. Stocks spent most of 2022 declining, and then most of 2023 rapidly rebounding to prior levels.

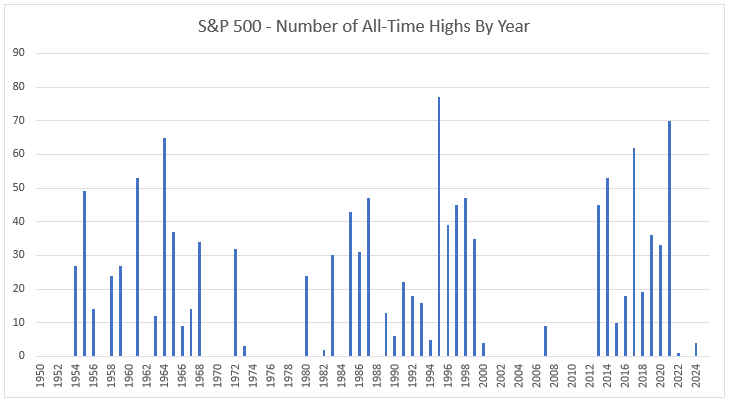

You might be wondering how investors should navigate the market now that stocks have advanced. Is the market riskier now? Is it time to sell? The following chart can provide some insight into these questions. It shows the number of days per year that the S&P 500 closed at a new high.

How should we interpret this graph?

Where there is no bar on the graph, these years had no new all-time highs. Since 1950, that applied to 31 out of those 75 years. (In fact, the S&P 500 still traded lower in 1950 than its prior high from 1929 – it took the market 24 years to recover from the Great Depression.) On the other hand, the tallest bars in the graph during the 1960s, 1980s, 1990s, and 2010s, show that the market reached new all-time highs multiple times per year. In 1995, it closed at a new high 77 times!

So how should investors approach a market environment where stocks are higher than they have ever been?

- Stay optimistic – While it’s true that stocks had positive returns last year, that fact alone does not indicate that future returns will be worse. Historically, there have been periods where stock markets trend higher for years or decades, making many new highs each year. It’s important that investors stay invested when stocks are down, but also when stocks are up.

- Stay realistic – Despite the long-term strength of the US stock market, there have been extended periods of weakness as well. For example, there were only 13 days with new highs from 2000 – 2012, averaging only one per year. Maintaining emotional balance during good and bad years is crucial to success over time.

- Stay diversified – Bonds can be a great way for investors to reduce the volatility in their portfolios. But even aggressive investors with no bond exposure have options to diversify. There are over 50 stock markets globally, and many are still trading at levels below previous highs. The Nikkei 225 index, which tracks Japanese stocks, is still trading below its levels from January 1990! Often times, global stocks have different characteristics and past returns, which can represent unique opportunities.

Thank you for allowing us to serve as your financial advisor. If you want to discuss how the current market environment impacts your investment portfolio, please let your advisor know.