Market Recap

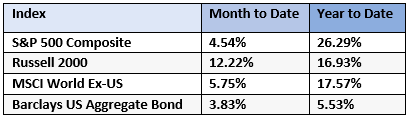

In December, financial markets continued higher. US small cap stocks increased the most, followed by international stocks and US large cap. Bonds also made positive returns. For the calendar year, all four investment categories produced gains.

Fourth Quarter Performances

In 1980, the Cleveland Browns had one of the most memorable seasons in franchise history. Coached by Sam Rutigliano and quarterbacked by Brian Sipe, they finished the regular season with an 11-5 record. During six of their victories, the Browns were behind in the fourth quarter, but scored in the final seconds of the game, winning by one touchdown or less. These suspenseful and thrilling wins earned the team the nickname, “The Cardiac Kids.”

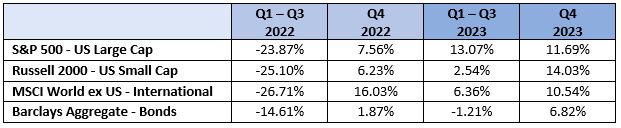

Just like football, we tend to measure investment performance in four quarters over a calendar year. For the second year in a row, financial markets have emulated those Browns games, staging their own noteworthy fourth quarter rallies. The chart below shows return details for the four indexes we monitor:

So how does this data affect you as an investor? We think there are a couple important points:

- Returns are irregular – While we might dream of a world where markets go up 1% every month, investments simply don’t work that way. The last two years show us that markets can fall rapidly, stay flat, or rise quickly. Over time, they do all three.

- Big years are common – Since 1990, the S&P 500 has returned more than 15% in 17 out of 34 calendar years, while losing money in 7 years. And as we can see from the data above, much of a big year can be attributed to a big quarter.

- Predicting returns is hard – Over the last two years, many economists and Wall Street investment strategists forecasted an economic recession and a continued bear market in stocks. So far, neither has occurred. Much of the time, the future is different than what we anticipate.

- Returns come with risk – The past two years have had many scary headlines – war, inflation, and economic uncertainty. These risks will persist into 2024 and investors will need to deal with them in the hopes of achieving future returns.

Happy New Year! We are thankful and honored for the opportunity to work with you. If you want to discuss your investment portfolio and how we can help you navigate the new year, please let me know.